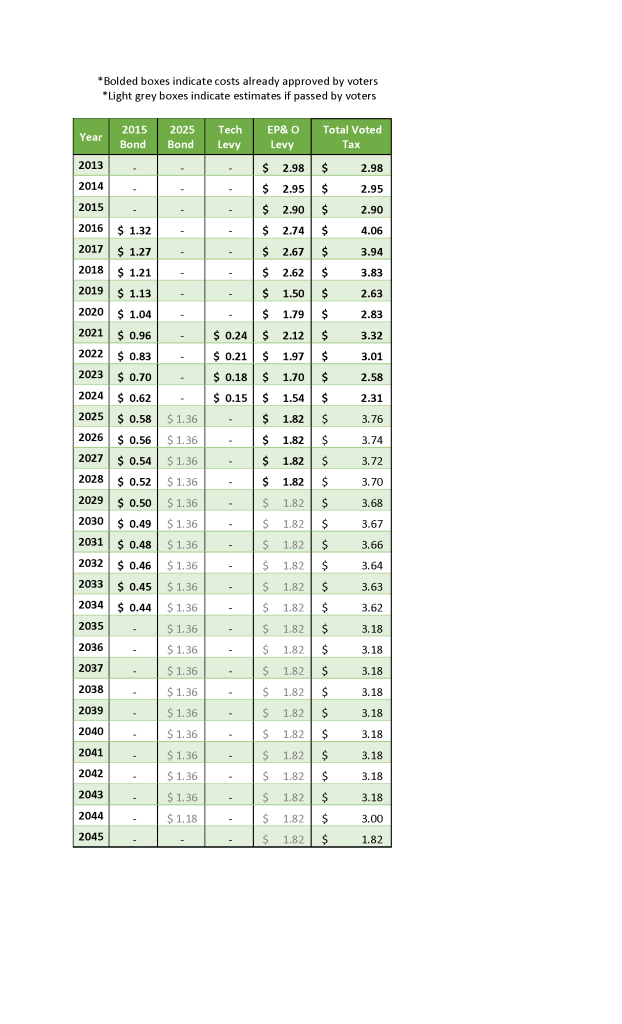

Tax Rate History and Projection

If this capital bond were to pass, we are estimating it would add $1.36 per $1000 of the total assessed value to a property owner’s taxes in 2025. All interest and fees associated with the Aug 6 bond are included within the district’s estimated rate calculations. This would increase the total combined voter-approved tax rate (school levy, LMS/Fisher bond) to an estimated $3.76 per $1000 in 2025.

If you own property, you can calculate your estimated 2025 tax increase using the formula:

Total Assessed Value / $1,000 x $1.36 = Estimated Annual Tax Increase