August 6 Bond

At the Lynden School District Board Meeting held on April 4, 2024, the Lynden School Board voted to place a Capital Projects Bond on the Aug. 6, 2024 ballot. This funding measure will ensure all students have access to programs and safe learning spaces that meet their learning needs. This decision was informed by the work of three citizen committees and a series of school board meetings which included public comment. The district is grateful to the members of this community who have invested their time, became informed, and were willing to engage productively in the process. There will continue to be opportunities and Lynden Schools is committed to providing information as part of an open and transparent process.

What would approval of a Capital Projects Bond pay for?

Approval of a Capital Projects Bond would ensure every student has access to space that meets their learning needs and access to courses that prepare them for success after graduation. School construction funding would allow us to address our highest safety and capacity needs:

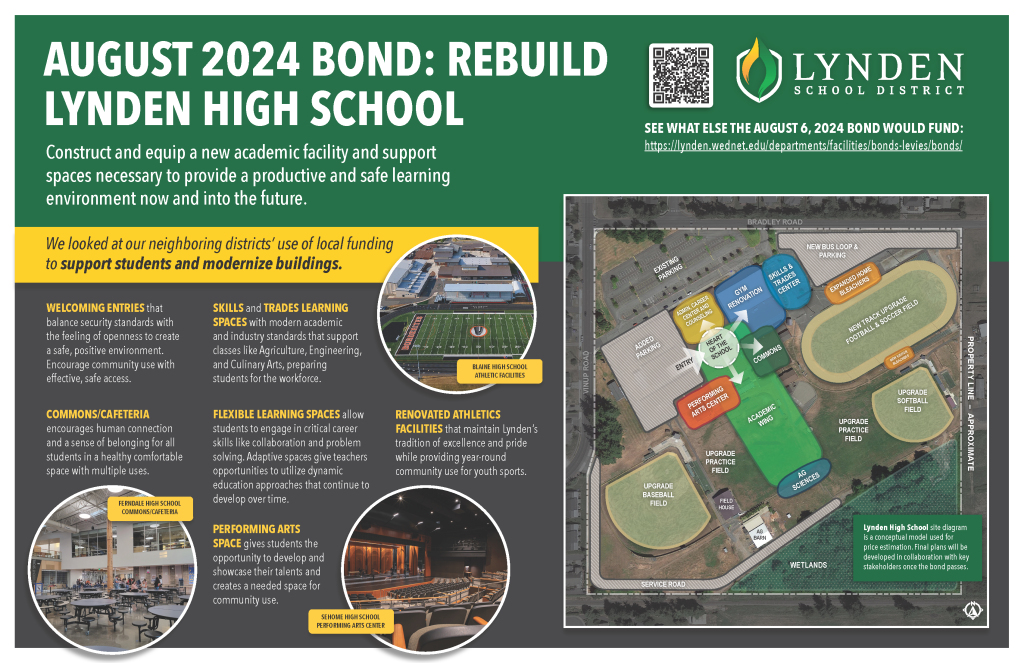

- Construct and equip a new Lynden High School to address enrollment growth, safety, aging facilities and purpose-built environments.

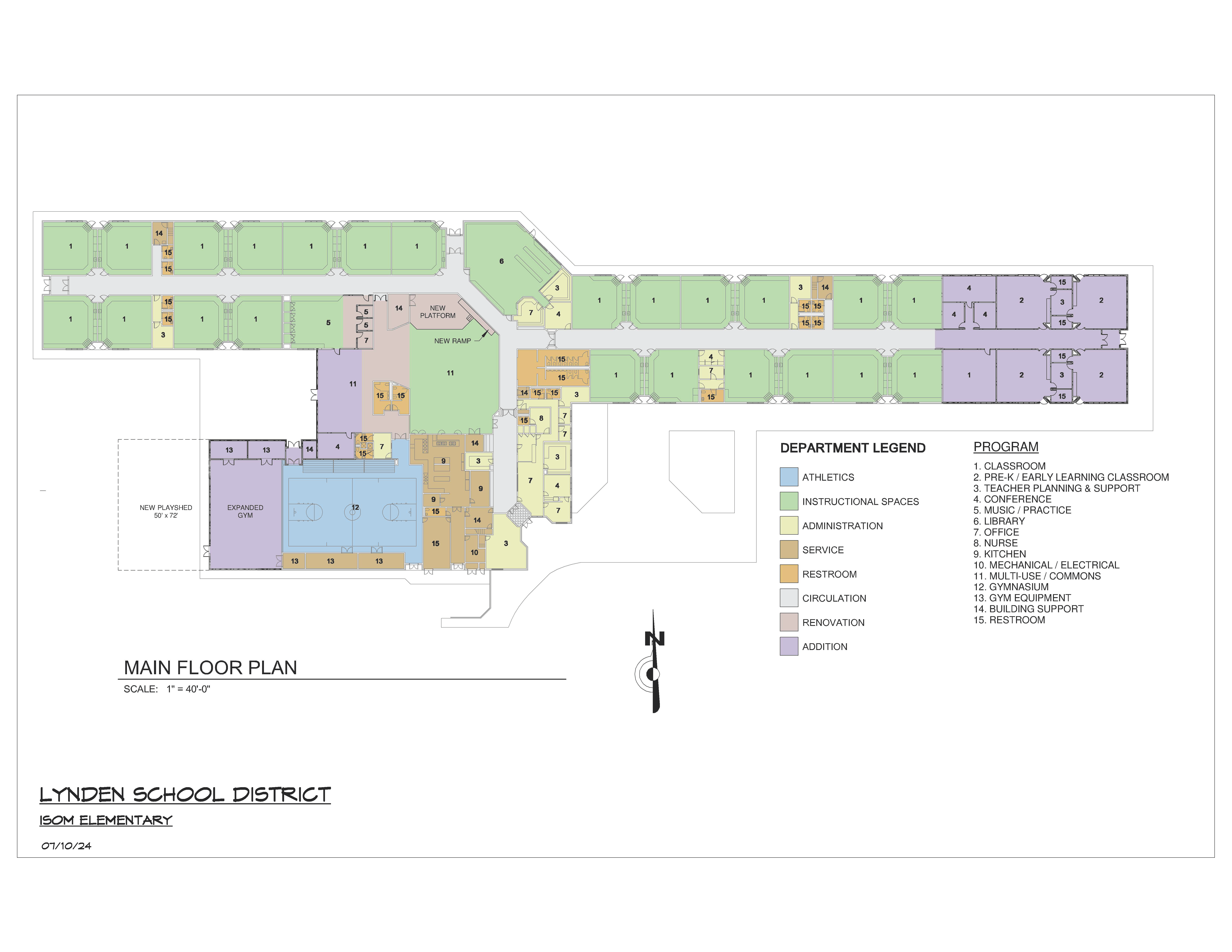

- Addition of permanent early learning and special education classrooms at Isom and Vossbeck elementaries to support enrollment growth and meet the special needs of learners.

- Undertake safety and playground enhancements at district facilities serving early learning, special education, and parent partnership programs.

- Upgrade HVAC systems throughout the district to extend life and improve air quality.

**The drawings above are conceptual only. The final design will be completed with citizen input after the bond passes.**

Cost of the Bond

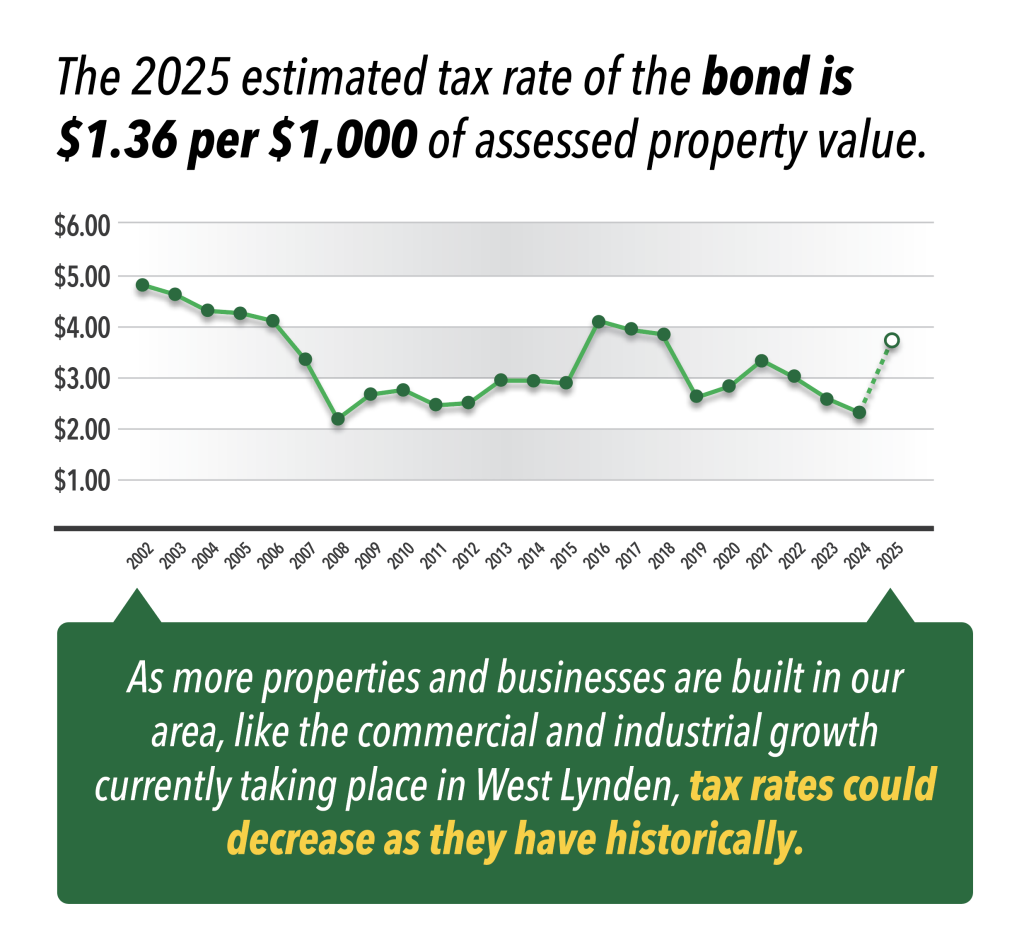

The total amount of the bond is $157.5 million. Bonds would be sold to investors (large banks, insurance companies) and paid back with interest over the next 21 years. Taxes are collected annually from property owners to make the debt payments. This is how public facilities are funded in Washington. Collection would begin in 2025. Each year the County Assessor’s Office calculates a millage rate (tax rate) which is used to determine how much each property owner will pay. If this capital bond were to pass, we are estimating it would add $1.36 per $1000 of the total assessed value to a property owner’s taxes in 2025. All interest and fees associated with the Aug 6 bond are included within the district’s estimated rate calculations. This would increase the total combined voter-approved tax rate (school levy, LMS/Fisher bond) to an estimated $3.76 per $1000 in 2025.

If you own property, you can calculate your estimated 2025 tax increase if the bond passes using the formula:

Total Assessed Value / $1,000 x $1.36 = Estimated Annual Tax Increase

Examples we often share include that a homeowner with $500,000 would see an annual increase estimated at $678 per year or $56.50 per month. The owner of an $800,000 home would see an increase of $1,088 or $90.67 per month. This is a significant investment in our community’s capital facilities.

The amount collected by the district is a set dollar amount each year. The tax rate is adjusted each year by the Assessor’s Office to ensure we don’t collect more money than approved by voters. This is understandably very confusing, so sharing the 2015 Fisher/LMS bond as a recent example can help. The tax rate for that bond was estimated at $1.39 per $1,000 in 2016 and is now set by the County Assessor for 2023 at $.60 per $1,000. If your home’s value in 2016 was $400,000 your annual tax would have been $556 ($400,000/1,000 x $1.39); that same home is likely closer to $850,000 in 2023 resulting in a $510 annual tax ($850,000/1000 x $0.60). The school district does assume a 5% to 6% annual increase to property values within its 21-year debt repayment structure which results in escalation of the total annual amount collected by the district. The complete projected tax rate analysis provided to the board prior to passing its resolution in April 2024 can be viewed here.

Also, an individual’s annual property taxes supporting school bonds and levies go up or down based on changes to their assessed value in relation to the total assessed value of all taxpayers within the district. If your property value increases by 20% from one year to the next but the total assessed value of all properties increases by 23%, your slice of the pie (total amount collected by the school district) would be reduced. Additional industrial & commercial properties, and housing developments, increases the total assessed value of properties within the taxing district.

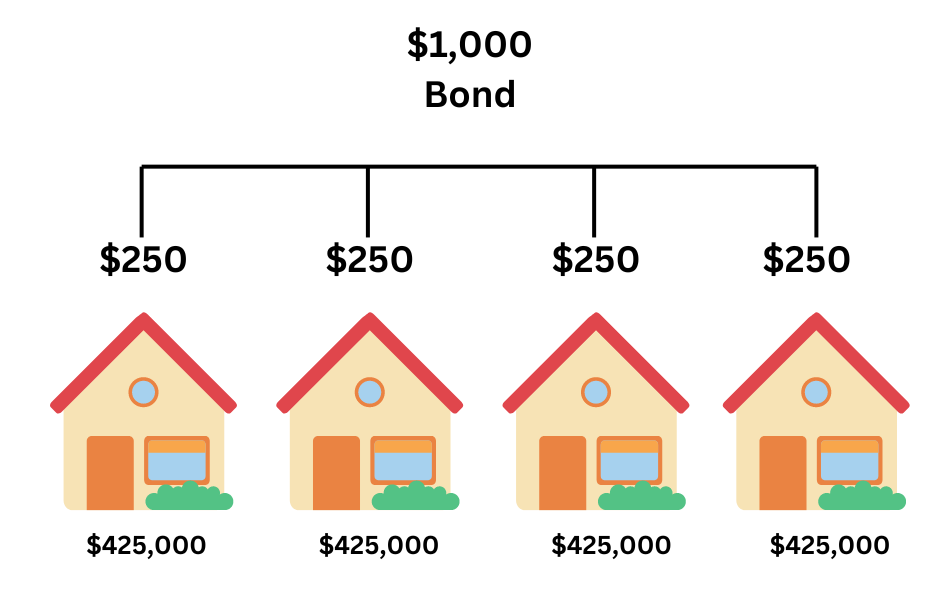

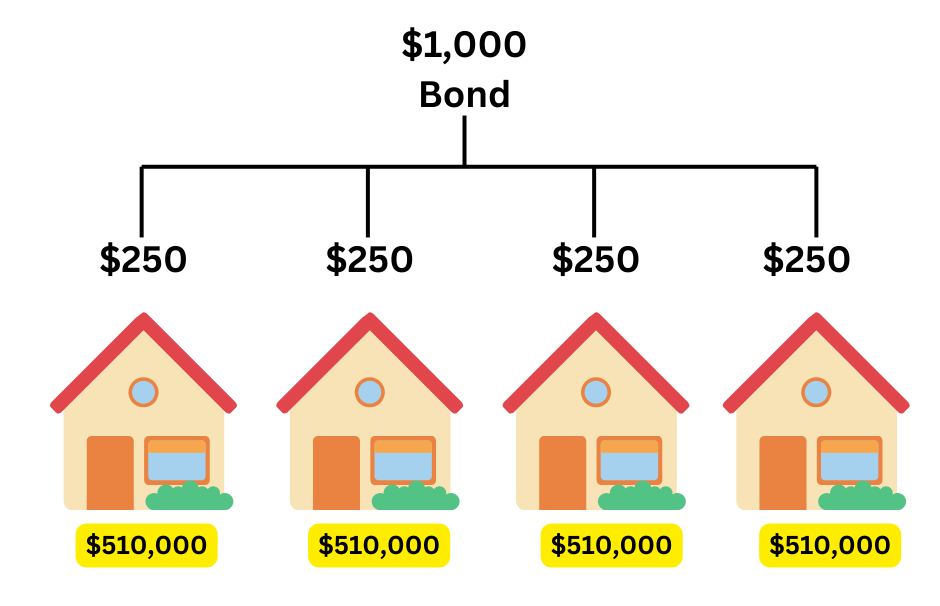

Here’s an over-simplified illustration of how adjusting tax rates annually helps keep tax collections consistent as property values increase.

If property values increase equally (20%) from one year to the next, then the tax rate is adjusted,

and same tax amount is collected by the district.

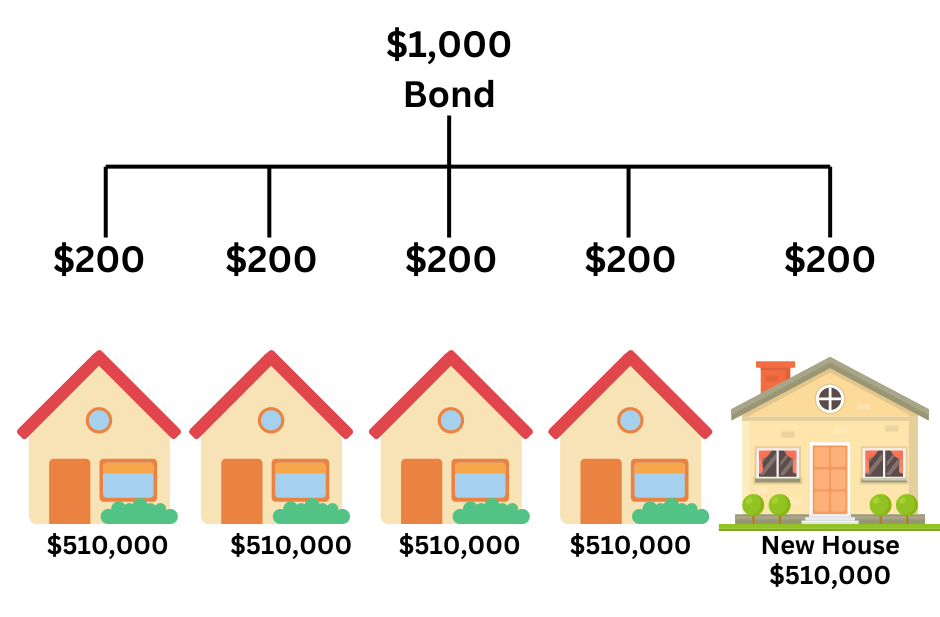

If scenarios in the example above remain true, here is an illustration of how additional homes (and hotels, dry pet food facilities, and Taco Bells) help distribute the tax burden across added properties.

Why does Lynden need a bond?

School districts in the state of Washington receive funding from local, state, and federal levels. However, the state does not fully fund education. That is why districts like ours rely on local property taxes to bridge the funding gap.

The state provides very little funding for school construction projects. In order to catch up with growing enrollment and ensure all students have access to spaces that meet their learning needs, school districts must ask the community to consider capital constructions bonds. Bonds provide school districts with a larger sum of money upfront to pay for major construction or land purchases, and the district pays it back over time.

Funding from the Aug 6 bond would be used to address capacity, provide permanent classroom space, and make safety updates across the district for the next 20 years.

Expanded Elementary Capacity: $18,817,302

– Additional permanent classroom space at Isom and Vossbeck to address districtwide elementary enrollment projections for the next 20 years.

– Safety and playground accessibility enhancements for early learning, special education, and parent partnership programs.

New High School & Community Assets- $129,732,698

– Added capacity, improved safety features, modern classrooms spaces, and expanded programs that support skills and trades education.

– Onsite and ADA-compliant Performing Arts Venue and updated athletic facilities for year-round community use.

– Facilities built to current industrial standards.

Safety & Operational Efficiency: $8,950,000

– Replace end-of-life heating and ventilation systems at Bernice Vossbeck and Isom Elementary Schools.

– Districtwide updates and repairs to heating and cooling systems to extend the life and efficiency of our buildings and improve air quality for our students.

– Add fire suppression system to Isom Elementary School.

There will be time between now and August to provide more detailed information and respond to the questions that will surely surface among our citizens. In the next couple of weeks and months, we will be meeting with community members to share information about the measures and how they support our students. By working in partnership, we can ensure our students and schools continue to have access to safe and updated learning spaces that meet their needs.