Aug. 6 Bond Election

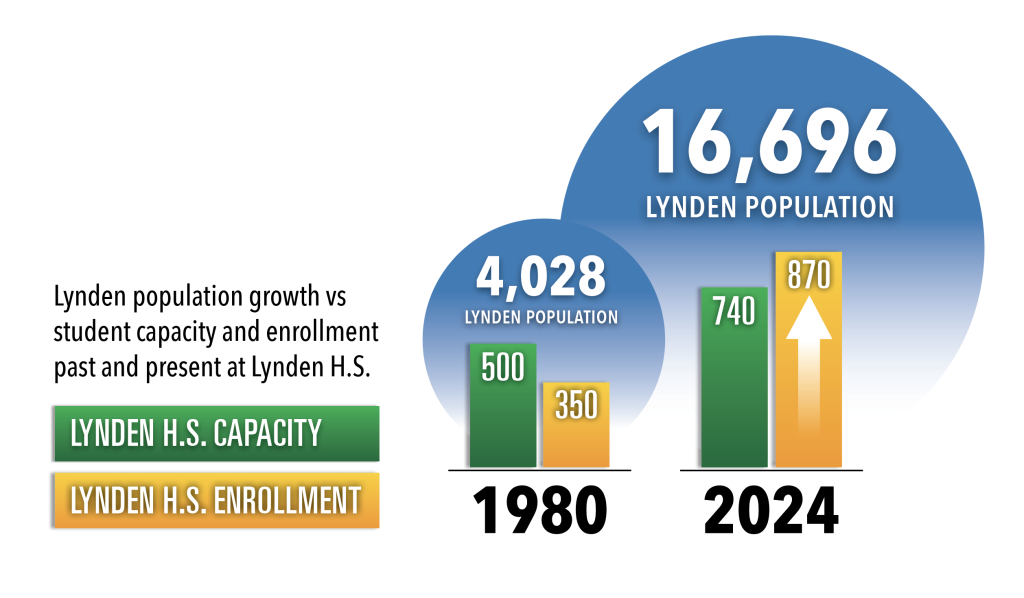

As our town continues to attract retirees and families with school-aged children, we are

committed to working together to meet the demands of a growing community.

The Lynden School District is asking the community to consider a Capital Projects Bond in the August 6 election.

Funding from this bond would be used to address capacity across the district for the next 20+ years. No additional bonds are planned.

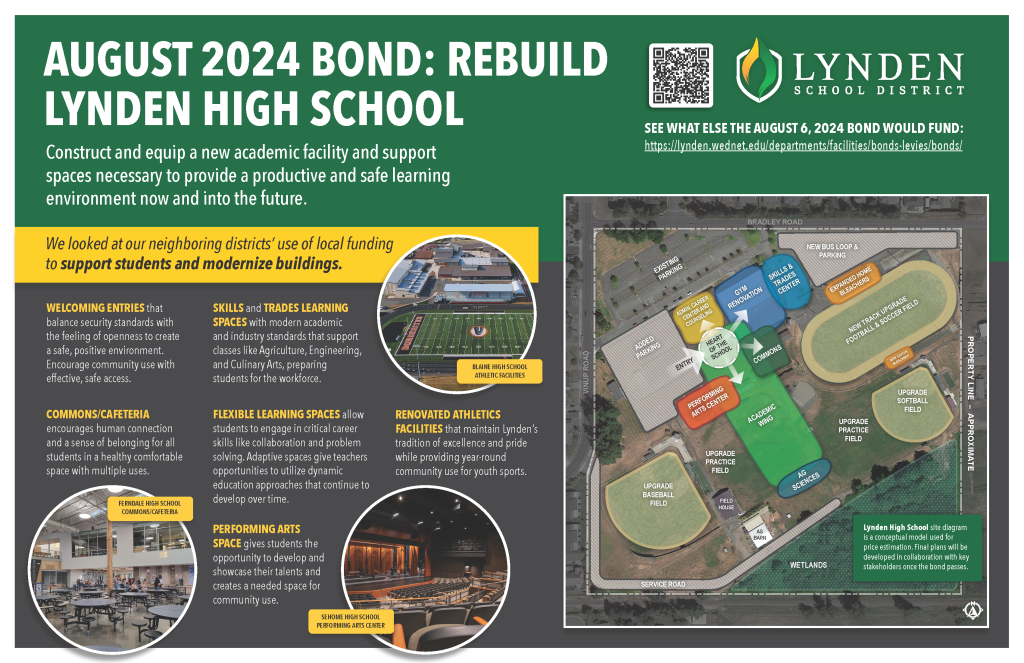

Replace Lynden High School

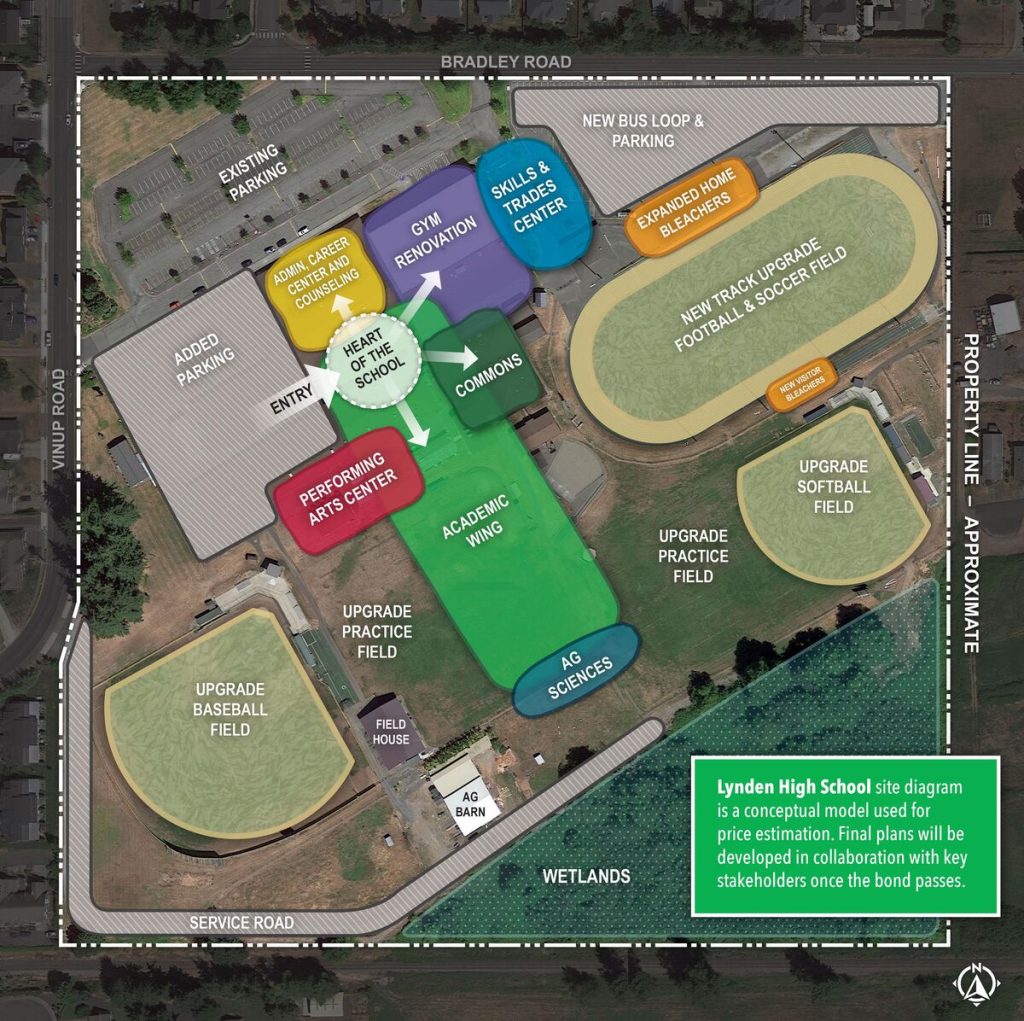

Lynden High School would be replaced on the same site and built large enough for 1200 students.

The project includes a Performing Arts Center, modernization of skills & trades learning spaces, and upgrades to its athletic facilities. The goal of the community high school is to meet the current and future needs of learners while expanding use of our facilities and fields by all citizens. We’d love to see regional and state events held in Lynden. The graphic below is ‘concept only’. Final design will be collaborative and include staff and stakeholder input once the bond passes.

The open concept of Lynden High School’s current campus presents safety and security challenges. The citizen-led Safety & Security Task Force recently completed their year-long analysis of district safety protocols and will be presenting its report to the Lynden School Board on June 20. Included within the report is a strong recommendation to implement current Crime Prevention through Environmental Design best practices within the design phase of all new schools. The current school was not built with safety as a consideration, our next school must.

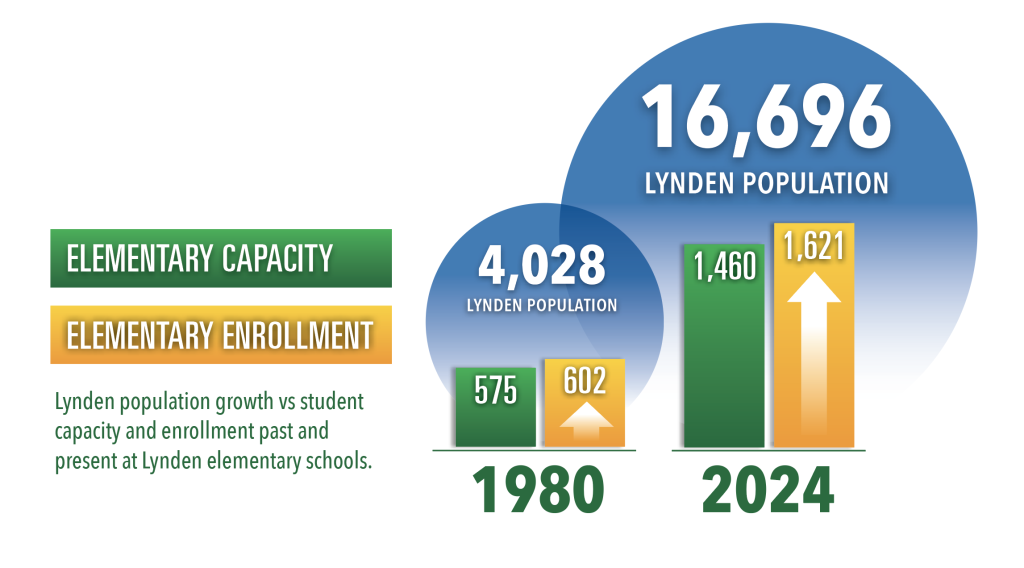

Expand and Update Bernice Vossbeck & Isom Elementary Schools

These two schools are built well and are worth the community’s investment. Permanent classroom wings (with restrooms) are scheduled to be added to both schools. The district plans to add a total of 10-12 classrooms reducing the dependency on portables. The classrooms at Isom would be purpose-built to serve 4- & 5-year-olds and students with special needs. Bernice Vossbeck would receive permanent general classrooms with upgrades to its early childhood and special education classrooms included within the plans. Both schools would also receive upgrades to their heating and air circulation to extend life and improve efficiency of operations.

Districtwide Improvements

Additional improvements across all facilities, including Lynden Academy, are included within the plans. Safety is prioritized which would result in increased access-controlled doors, fencing, and camera surveillance coverage. Second floor air cooling at both Fisher and Lynden Middle School has become a necessity and would be addressed.

And finally, not all Lynden students have access to playground equipment and this project would help us take steps to improve these environments for all learners.

Ballots Arrive July 19

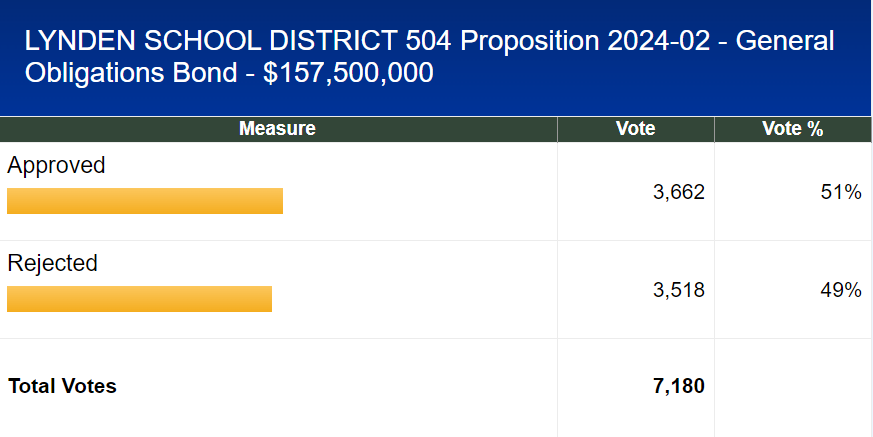

60% approval is required to pass a school construction bond. The Lynden School District received 51% approval on the February ballot.

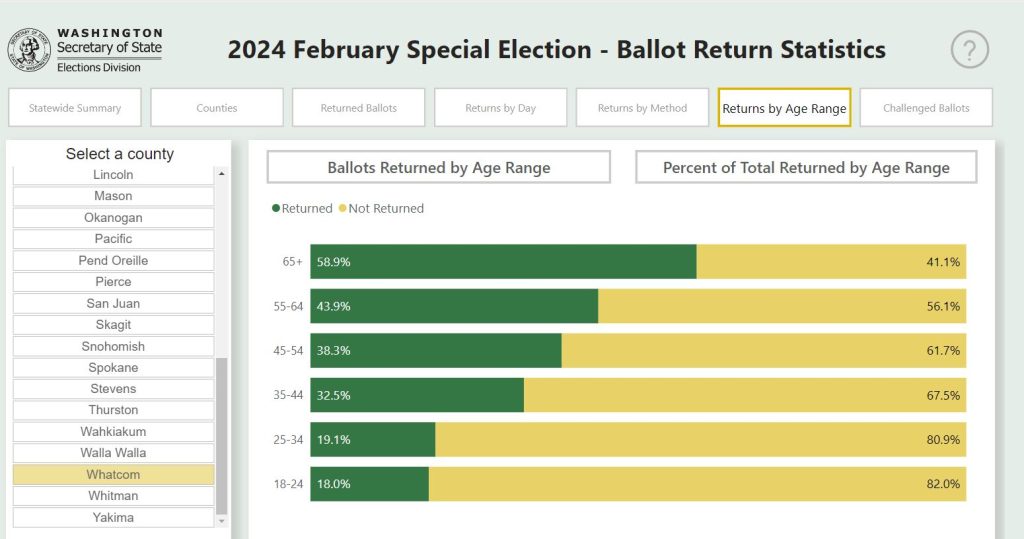

Voting in elections is generally considered important but not a perspective supported by voter turnout data. Only 38% of registered Whatcom County voters turned in a February ballot. Parents of school-aged children are also a low-turnout demographic.

Summer months have families on the move. Ballots are scheduled to arrive to households on July 19 and are due by 8:00 PM on August 6. Please ‘MAKE A PLAN’ to cast a vote in this August election. If you haven’t registered to vote and are eligible, please do so now at VoteWA.gov.

Cost of the Bond

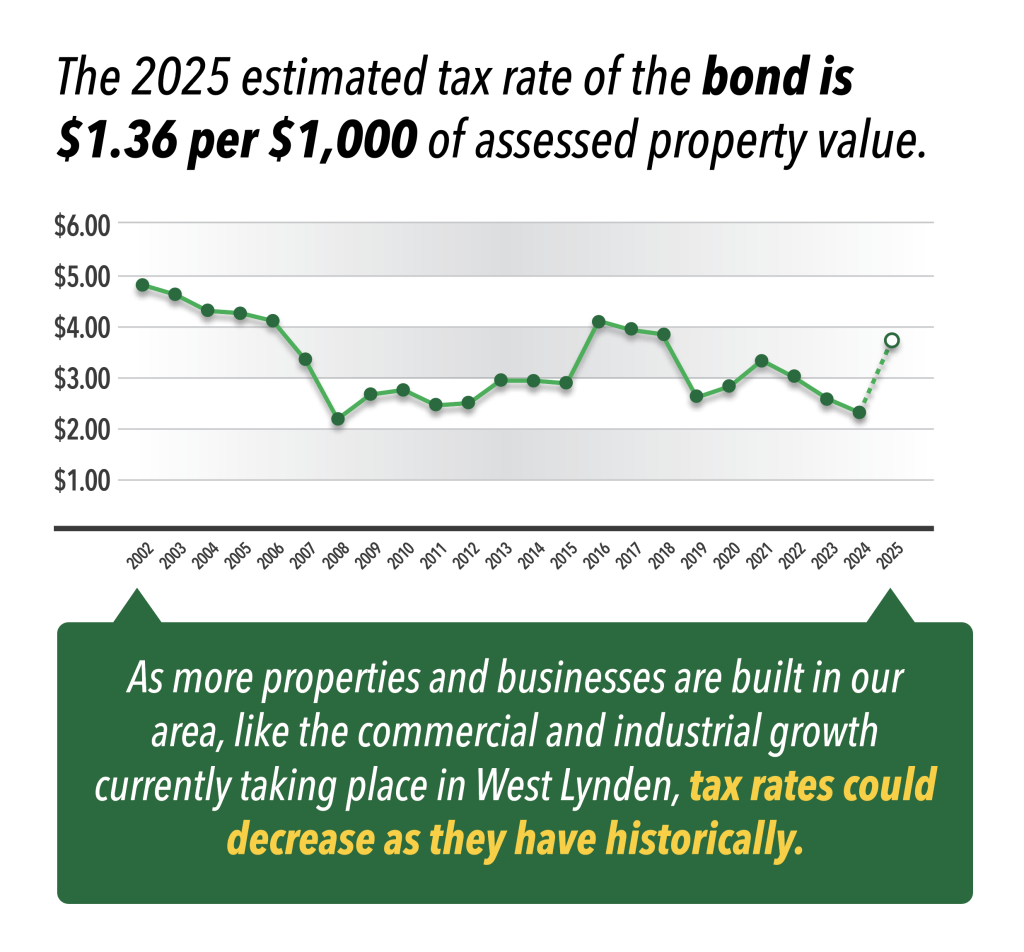

The total amount of the bond is $157.5 million. Bonds would be sold to investors (large banks, insurance companies) and paid back with interest over the next 21 years. Taxes are collected annually from property owners to make the debt payments. This is how public facilities are funded in Washington. Collection would begin in 2025. Each year the County Assessor’s Office calculates a milage rate (tax rate) which is used to determine how much each property owner will pay. If this capital bond were to pass, we are estimating it would add $1.36 per $1000 of the total assessed value to a property owner’s taxes in 2025. All interest and fees associated with the Aug 6 bond are included within the district’s estimated rate calculations. This would increase the total combined voter-approved tax rate (school levy, LMS/Fisher bond) to $3.76 per $1000 in 2025.

If you own property, you can calculate your estimated 2025 tax increase if the bond passes using the formula:

Total Assessed Value / 1,000 x $1.36 = est. annual tax increase

Examples we often share include that a homeowner with $500,000 would see an annual increase estimated at $678 per year or $56.50 per month. The owner of an $800,000 home would see an increase of $1,088 or $90.67 per month. This is a significant investment in our community’s capital facilities.

The amount collected by the district is a set dollar amount each year . The tax rate is adjusted each year by the Assessor’s Office to ensure we don’t collect more money than approved by the voters. This is understandably very confusing, so sharing the 2015 Fisher/LMS bond as a recent example can help. The tax rate for that bond was estimated at $1.39 per $1000 in 2016 and is now set by the County Assessor for 2023 at $.60 per $1000. If your home’s value in 2016 was $400,000 your annual tax would have been $556 ($400,000/1000 x $1.39); that same home is likely closer to $850,000 in 2023 resulting in a $510 annual tax ($850,000/1000 x $0.60). The school district does assume a 5% to 6% annual increase to property values within its 21-year debt repayment structure which results in escalation of the total annual amount collected by the district. The complete projected tax rate analysis provided to the board prior to passing its resolution in April 2024 can be viewed here.

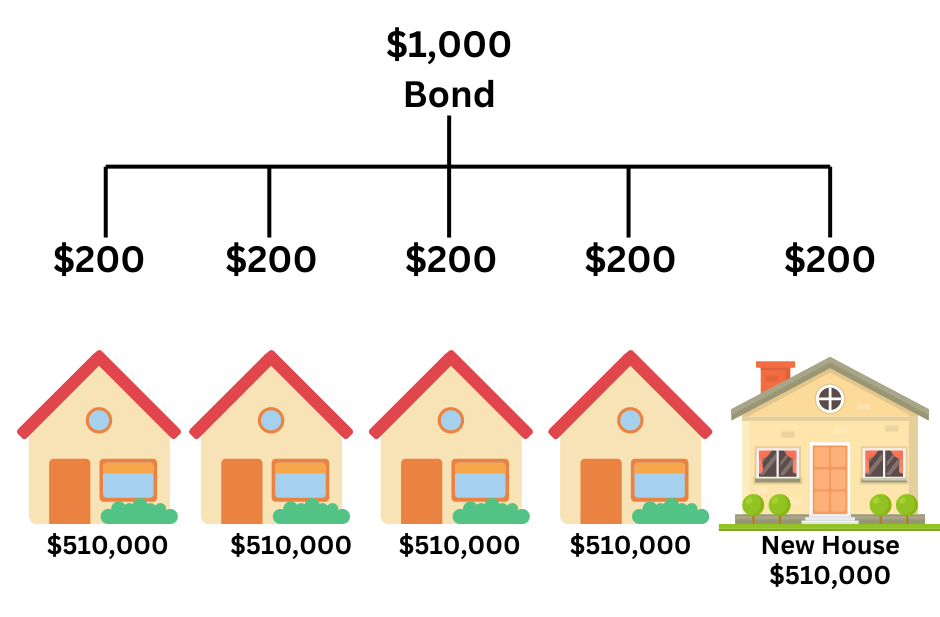

Also, an individual’s annual property taxes supporting school bonds and levies go up or down based on changes to their assessed value in relation to the total assessed value of all taxpayers within the district. If your property value increases by 20% from one year to the next but the total assessed value of all properties increases by 23%, your slice of the pie (total amount collect by the school district) would be reduced. Additional industrial & commercial properties, and housing developments, increases the total assessed value of properties within the taxing district.

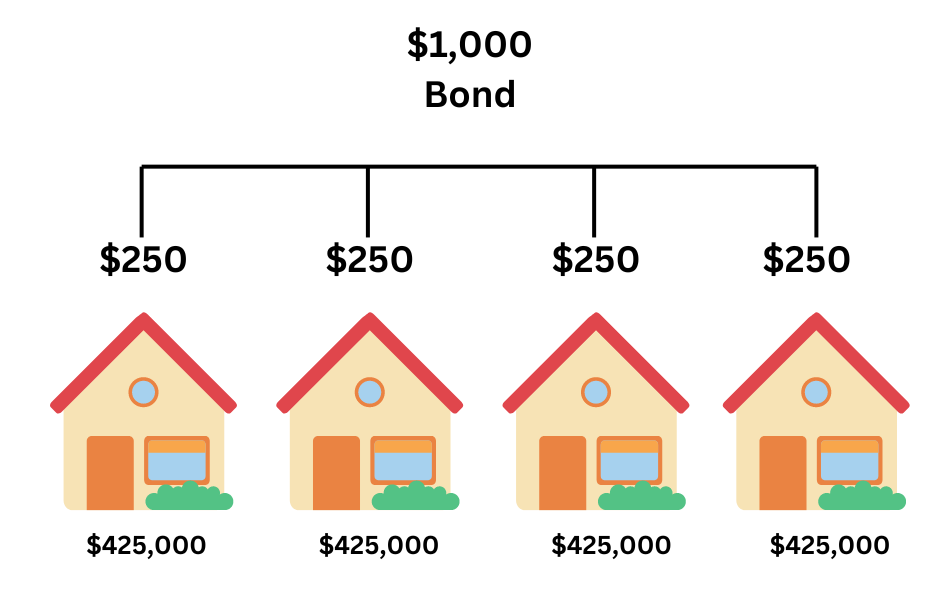

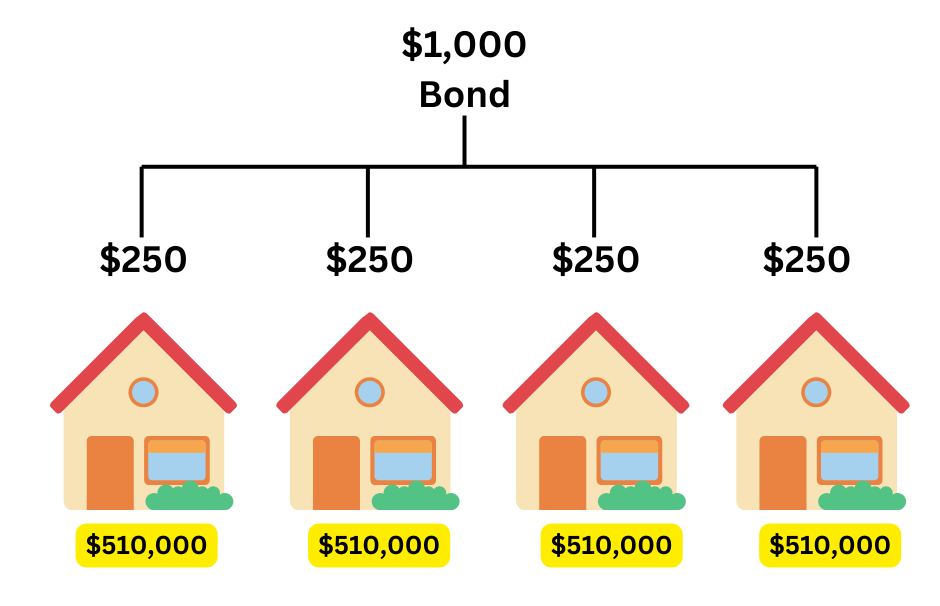

Here’s an over-simplified illustration of how adjusting tax rates annually helps keep tax collections consistent as property values increase.

If property values increase equally (20%) from one year to the next, then the tax rate is adjusted, and same tax amount is collected by the district.

If scenarios in the example above remain true, here is an illustration of how additional homes (and hotels, dry pet food facilities, and Taco Bells) help distribute the tax burden across added properties.

Message of Gratitude

The community of Lynden continues to grow. We are a special, youth-focused community and I’m personally committed to the ‘Excellence – Pride – Tradition’ of Lynden Schools remaining as a key contributor to the futures of our children and families.

Thank you for engaging in the process. Please don’t hesitate to reach out with specific questions or just to share thoughts about your own vision for the future of our schools. Best way to contact me is via email at vanderyachtd@lynden.wednet.edu.